Full disclosure, i work for a company that provides it. We are interesting in learning if dealers have any aversion to offering used vehicle leasing to their payment shoppers. We plan on becoming aggressive in the space and are looking to learn more about what the sales people/desking managers and F&I people feel is important to effectively offer it to their customers.

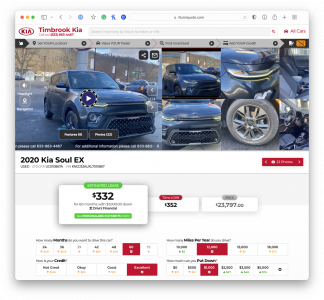

I assume that most important would be to integrate with desking platforms, enable website plugins to show default payments on eligible vehicles as well as ensure that compensation is in line with finance reserves. Does anyone have any thoughts or opinions on the subject?

I assume that most important would be to integrate with desking platforms, enable website plugins to show default payments on eligible vehicles as well as ensure that compensation is in line with finance reserves. Does anyone have any thoughts or opinions on the subject?