- May 1, 2006

- 3,636

- 2,582

- Awards

- 13

- First Name

- Alex

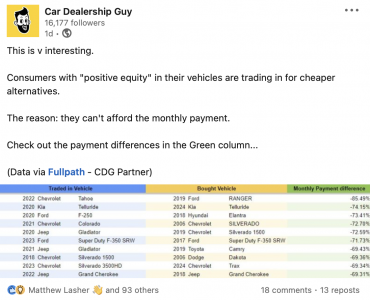

The data looked a bit cherry-picked and the story wasn't adding up for me. So, we looked at all the sales we had for the past 3 months.

- The average equity on trades was $9,560.

- The average age of trades was 47 months which equates to a 2019 model year.

- There was very little difference in terms financed originally to the next vehicle. If they financed for 72 months in 2019, they financed for 72 months in 2023.

- The APR increased 1.8% since their last purchase, on average.

- The monthly payment increased by $191, on average, per month to go along with that APR... plus some decent dealer profit.

Most customers stepped up in car. Few went backward from doing some visual scans of the data. I'd like to go back and focus on the deals where the original MSRP of the trade was higher than the MSRP of the car they bought in 2023. I think that would be a better representation of what FullPath and the Car Dealership Guy are trying to imply.

For the record, I'm a huge fan of the Car Dealership Guy. I mostly follow him on LinkedIn. I just thought this data smelt fishy.