- Apr 7, 2009

- 4,633

- 2,122

- Awards

- 10

- First Name

- Joe

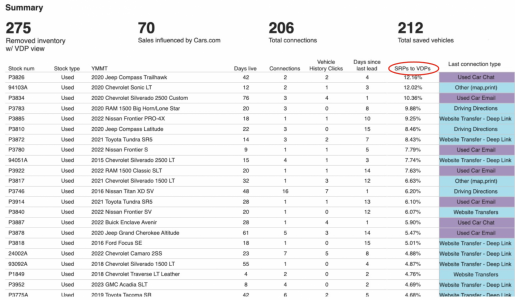

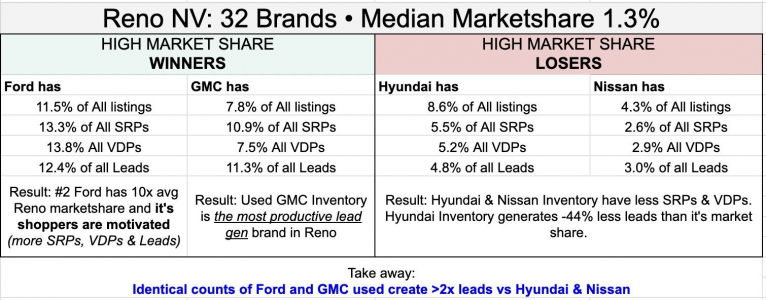

Assessing metrics like cost per vdp view, cost per lead, and cost per sale is a smart approach to ensure you're getting the best value from third-party platforms.

Cause & Effect

Cause:

- 3rd party sites know dealers OBSESS about lead gen volume and...

- ALL OTHER DATA is not important to dealers... so...

- 3rd party sites know if can't produce lead volume, they die.

3rd party sites know less product support data = MORE LEADS.

- Here is the Lead Gen Algo as seen from inside a 3rd party site:

- Most shoppers are NOT product literate.

- They have near zero trim hierarchy knowledge

- They're unaware of the hundreds of feature choices

- Use "Deal Rank" & price as the anchor of your Car Shopping Experience.

- Drop/reduce/hide vehicle's features, lead gen goes up.

- "Deal Rank" & photos becomes the shoppers anchor for product discovery

- Most shoppers are NOT product literate.

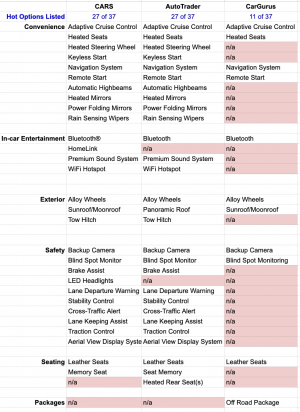

Summary: All car shoppers want a balance of finding the best car at the lowest price. From my seat, CarGuru's lead gen success forced AT and CARS to follow. CG intelligently used the dealer's inventory and the dealer's insistence on lead volume to give the dealers what they want. Leads, Leads, Leads. CARS and AT create a UX that is far more 'product centric' than gurus.