Thank you for opening the discussion, Molly. A subject near and dear to my heart.

The VAB study was based on a nationwide sample size of 1,000 consumers who plan to purchase in the next six months. I'm always wary of primary research funded by an organization who supports a particular trade. The question is, when looking at syndicated qualitative research (less biased) from a company like Simmons or Scarborough do those influences hold up? And when you look at the households who are geographically located near your store, specifically shoppers who have recently registered the specific model(s) you sell, what mediums are most effective? (full disclosure, our company, String Automotive, provides these insights).

Starting with the specific demographics for the model you are promoting, or need to move most desperately to achieve sales effective numbers, build individual heavy up campaigns with mediums specific to advancing those sales. By taking a model specific approach, you can avoid a broad spray and pray message which is less effective.

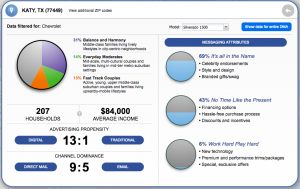

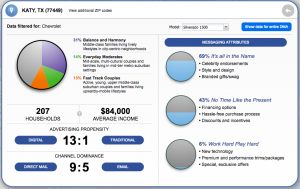

Using an example from a zip code in a large market:

Katy, TX, demonstrates a strong propensity for digital media. Putting it another way, the importance of having a strong presence in digital is much greater if you are selling cars in the suburbs of Houston. The Silverado, demographics support a similar story.

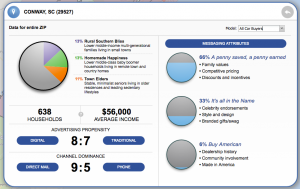

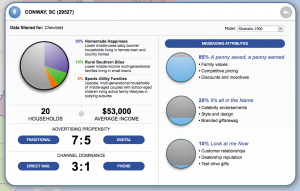

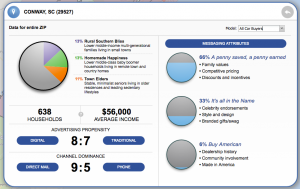

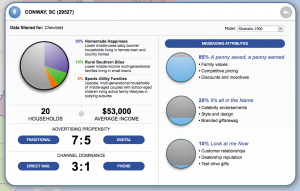

Smaller market:

In Myrtle Beach, SC, the propensity is much more even and traditional plays a greater role, especially when you are trying to move more Chevy trucks.

The questions posed in the VAB study are valuable because they speak to the influence each medium has on varying demographics, nationwide. However, we should all be careful to take that research into consideration when making changes to

local budgets without reviewing the data from your own market, specifically, your PMA/AOI and the demographics for each of your specific models.

As for seeking metrics to confirm your current television spend, you can isolate your direct and branded traffic in Google Analytics and compare your flight dates and spot times. If you are buying broadcast television, you will almost always see a lift in traffic and conversions for each daypart, e.g., prime time, early fringe, late fringe, etc. However, that approach simply looks to report on cause and effect. Spots ran, traffic increased. However, a lift in traffic does not always correlate to a lift in sales for a specific model. So, using those stats to imply a return on investment from TV spend would be naive. As mentioned above, you have to take the entire journey into consideration. If you run a lease special on a Camry, lift your traffic, but demonstrate a conflicting offer to your visitor online, the journey and the attribution of that visitor is flawed.

Most importantly, track whether each mix of media that you choose for a specific model is making an impact in the zip codes where you need to achieve greater saturation. Until you can prove that you are incrementally lifting your sales beyond the current market share you are or should be achieving, keep the tweaks to your budget mild and calculated. Then, once you've achieved a certain saturation, you can play with wider reaching mediums.

Strategy reports for any new model and are available for any dealership in the U.S. for free. Just make a request to any member of our team.