- Apr 26, 2013

- 10

- 5

- First Name

- Brad

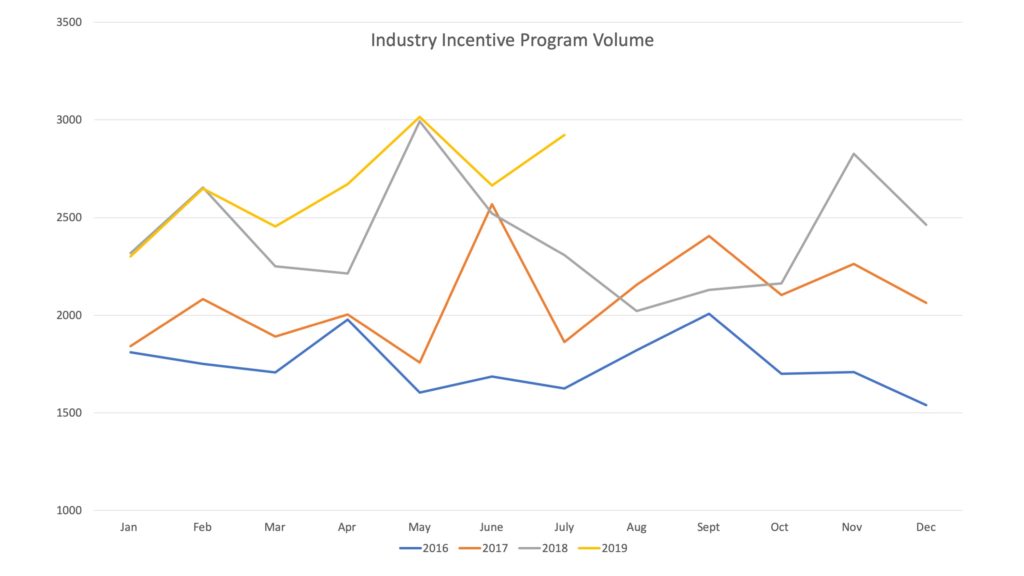

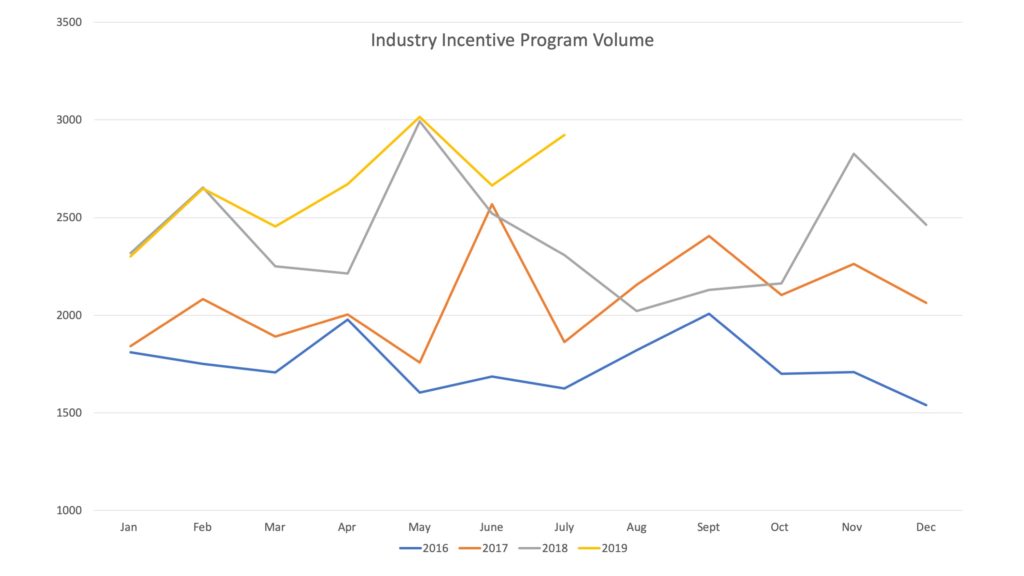

July 2019 is expected to be officially the hottest month in history, temperature wise. The same might be said for the level of sales incentives offered by the automakers. This time of year, we often see a slowdown in the number of incentives available, as model year changeovers and strong spring sales have dwindled vehicle supply on dealer lots.

That was not the case last month. (See chart below). The volume of unique incentive programs ran high in July 2019, as they have all year with the OEMs battling a trifecta of challenges impacting new–vehicle sales:

Our team watches incentives carefully each month, to help both consumers and dealers calculate accurate price and payment data for new cars. In the past few years, we’ve seen the automotive manufacturers become increasingly strategic with their incentive disbursements, offering incentive programs at the VIN, option package/code and geographic levels. We’re also seeing numerous competitive offers, which helps retailers manage monthly payments and financing offers to meet the needs of buyers struggling with the affordability of new vehicles.

Our team watches incentives carefully each month, to help both consumers and dealers calculate accurate price and payment data for new cars. In the past few years, we’ve seen the automotive manufacturers become increasingly strategic with their incentive disbursements, offering incentive programs at the VIN, option package/code and geographic levels. We’re also seeing numerous competitive offers, which helps retailers manage monthly payments and financing offers to meet the needs of buyers struggling with the affordability of new vehicles.

All these factors are pushing higher the raw number of incentive programs in the market today. More programs mean more deals, so new-car buyers need to make certain they are receiving all available incentives. And it is worth noting, not all buyers are eligible of all special rates or incentives, so it pays to ask and do the research.

But just like sweltering July heat, incentive volume could cool off quickly, although chances are we won’t see a slow down until inventory levels drop another 10%. Pending July sales, the program count may stay hot into August.

Note: Chart shows total volume of unique incentive programs, across all makers. This number does not indicate value of the programs, only volume. For example, in July 2019, Toyota carried 137 unique incentive programs, Nissan had 252 and Honda 68. Ford, conversely, which typically carries numerous regional and national programs across its vast line of vehicles, had 597 different incentive programs in play across the country. In total, there were 2,923 unique programs available in July 2019, up from 2,664 last month and up from 2,307 in July 2018.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.

That was not the case last month. (See chart below). The volume of unique incentive programs ran high in July 2019, as they have all year with the OEMs battling a trifecta of challenges impacting new–vehicle sales:

- Stubbornly high interest rates are driving higher payments for new–vehicle buyers.

- Increased content is pushing the Manufacturer’s Suggest Retail Price (MSRP) higher. The average MSRP through the first half of 2019 is north of $39,500, according to our Kelley Blue Book data team.

- There’s a large surplus of “nearly new” vehicles on dealer lots serving as smart alternatives to a new, zero-mileage vehicles.

All these factors are pushing higher the raw number of incentive programs in the market today. More programs mean more deals, so new-car buyers need to make certain they are receiving all available incentives. And it is worth noting, not all buyers are eligible of all special rates or incentives, so it pays to ask and do the research.

But just like sweltering July heat, incentive volume could cool off quickly, although chances are we won’t see a slow down until inventory levels drop another 10%. Pending July sales, the program count may stay hot into August.

Note: Chart shows total volume of unique incentive programs, across all makers. This number does not indicate value of the programs, only volume. For example, in July 2019, Toyota carried 137 unique incentive programs, Nissan had 252 and Honda 68. Ford, conversely, which typically carries numerous regional and national programs across its vast line of vehicles, had 597 different incentive programs in play across the country. In total, there were 2,923 unique programs available in July 2019, up from 2,664 last month and up from 2,307 in July 2018.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.