- Mar 9, 2011

- 39

- 16

- First Name

- Jeff

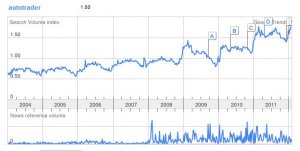

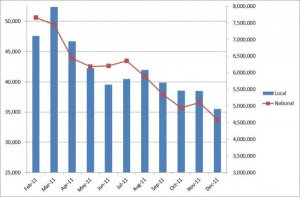

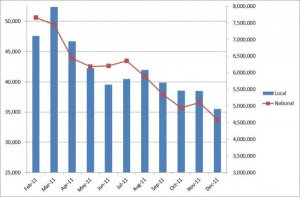

I ran across an article about Quantcast.com which "quantifies" website traffic. After looking at a few websites, I took a shot at AutoTrader and the results were quite interesting. Now, I'm not one to trust some website's "estimate" of traffic... that would be naive... so I graphed the "Audience" numbers from my AutoTrader reports for 2011 against the Quantcast stats and they really do correlate:

To the assembled internet marketing wisdom here I present this information in hopes of learning a few things:

1) Is this true in your market as well and has it come with a corresponding drop in leads?

2) If Quantcast is accurate, Cars.com has also dropped (not as much) over the same year, so where are people going to search for cars?

3) It would appear that the ROI from AT and Cars.com are dropping... shouldn't our bills?

In addition, I want to point out that the actual stats I'm using from my market (Flint/Saginaw, MI) were part of our monthly back-end reporting in 2011, but do not show in January 2012. Perhaps they realized that someone would point out their loss of traffic?

To the assembled internet marketing wisdom here I present this information in hopes of learning a few things:

1) Is this true in your market as well and has it come with a corresponding drop in leads?

2) If Quantcast is accurate, Cars.com has also dropped (not as much) over the same year, so where are people going to search for cars?

3) It would appear that the ROI from AT and Cars.com are dropping... shouldn't our bills?

In addition, I want to point out that the actual stats I'm using from my market (Flint/Saginaw, MI) were part of our monthly back-end reporting in 2011, but do not show in January 2012. Perhaps they realized that someone would point out their loss of traffic?