I believe the Market Scan API is a lot more than taxes & fees. It is primarily payment calculations and structuring with state tax and fees as a component of the payments. It is the Cadillac of payment APIs and comes with Cadillac pricing. For a single rooftop application, that could be like exterminating an ant hill with a nuke.

There are taxes and fee tables that can be purchased. The issue you'll run into,

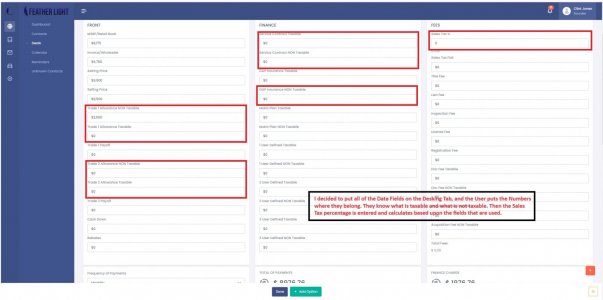

@Tallcool1, is understanding how to put those things together. Some states are incredibly complex depending on how the vehicle is financed, the weight, the price, what kind of engine it has, whether trade equity is at play, and all sorts of other fun things.

There are town jurisdictions with different tax rates than the rest of the county and counties that do things differently than the state. Zip codes are not the only indicator of which area needs to be taxed in which way. We sometimes have had to resort to asking the customer for clarifications on where they live to hit the accuracy levels we get at

FRIKINtech. We also have to ask the customer for some details about their trade to fill in other parts. Domestic trucks are a huge barrier to the latter. EVs are the new fun.

So,

@jscole86 is right in recommending Market Scan as that is the top-of-the-line system for accuracy. OfferLogix takes a bit more effort to get to that same level, but costs less and can get there with the right subject matter expertise (algebraic understanding of leasing - if you need those, enough time behind a desk to appreciate the nuances of a dealership & deal structuring & new car incentives, and finally the technical expertise to decipher and implement complex APIs). However, without knowing more about your application, it is hard to recommend a direction.

P.S. This post is a waaaaay overkill response.