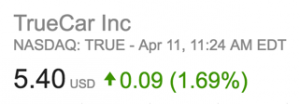

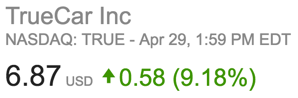

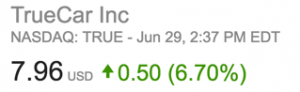

Been watching TrueCar's stock price (

TRUE) since it's train wreck this year. It's at $5.84, I had expected it to fall further.

Is this a buying opportunity (like when Martha Stewart went to jail

? Or is this a "calm before the storm" (like buying Kodak because it had a zillion patents on digital photography)?

On the up side, TRUE's concept is a winner with car shoppers.

On the down side, TRUE's biz model has failed.

My $0.02

Uncle Joe Rule #88: "Just because it's a good idea doesn't mean it'll work"

TRUE's concept (a mobile shopping tool used at the dealership) is perfectly aligned with the shoppers workflow. TRUE's JD Power shopper score is best of breed. Google loves the brand (it scores well for seo). Everything is right, except, shoppers only want to use it anonymously as a shopping tool.

The TRUE biz model assumed the shopper would gladly participate with revenue generating activity... they were wrong.

What's coming?

Will TRUE's remaining leadership find some brave soul to become the new CEO? This person has to be smart enough to keep TRUE's place in the shopper's workflow, but, find some new way to make money from it.

TRUE reports Nov 5th. This will be very interesting. I'd bet investors will be hot as hell and pushing for a buyout or anyway to stop the bleeding.