- Dec 14, 2017

- 3

- 2

- First Name

- Pat

Thank you Alex for allowing this post.

This post is probably going to be most interesting to Dealership Owners, Comptrollers, Accountants, GM's of dealerships.

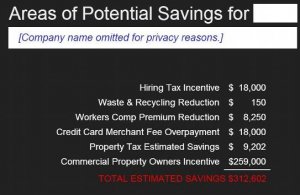

I work with auto dealerships in helping them get Specialized Tax Breaks, usually not available from an accountant. So, we work hand-in-hand with the dealership owner's accountant, in capturing these tax incentives.

We also focus on Expense Reductions (without you have to change vendors/suppliers).

We've worked with almost every automotive dealership brand. Basic information can be found here:

http://gmgsavings.com/solutions-by-industry/automotive/

Average savings range from tens of thousands to hundreds of thousands of dollars per location.

Everything we do is contingency-based, meaning we do an analysis and a feasibility study of the savings potential, at no charge. If we find savings, our fee is a percentage of the savings we capture for the client. Attached image represents a sample analysis for an automotive dealership I'm currently working with. Please contact me directly with any questions.

Pat

https://www.linkedin.com/in/patgrahamblock/

410-634-1640 (Direct line)

This post is probably going to be most interesting to Dealership Owners, Comptrollers, Accountants, GM's of dealerships.

I work with auto dealerships in helping them get Specialized Tax Breaks, usually not available from an accountant. So, we work hand-in-hand with the dealership owner's accountant, in capturing these tax incentives.

We also focus on Expense Reductions (without you have to change vendors/suppliers).

We've worked with almost every automotive dealership brand. Basic information can be found here:

http://gmgsavings.com/solutions-by-industry/automotive/

Average savings range from tens of thousands to hundreds of thousands of dollars per location.

Everything we do is contingency-based, meaning we do an analysis and a feasibility study of the savings potential, at no charge. If we find savings, our fee is a percentage of the savings we capture for the client. Attached image represents a sample analysis for an automotive dealership I'm currently working with. Please contact me directly with any questions.

Pat

https://www.linkedin.com/in/patgrahamblock/

410-634-1640 (Direct line)