- Mar 21, 2012

- 1,090

- 1,447

- Awards

- 10

- First Name

- Ryan

So we recently acquired a new dealership and ran into this exact issue when examining the dealership's paid search account.3. Running Multiple New Vehicle Model PPC Ads in a Single Google Ads Campaign

Too many vendors throw all of their new vehicle model paid search ads in a single Google Ads campaign. For example, they have ad groups created for each model underneath a single make campaign.

- Campaign: New Chevrolet Vehicles

- Ad Group: Malibu

- Ad Group: Silverado

- Ad Group: Impala

- Ad Group: etc…

Why is this bad?

- You have no control over the spend of each individual model, you’re primarily leaving it up to Google to determine based on each ad groups’ search volume, performance, and bids. What if you really want to focus on Silverado’s one month and pull back on Malibu’s? This type of setup makes it difficult to accomplish.

- You have no control over the geo targeting of each individual model, every model gets the same geo targeting. In a lot of markets you may want to focus on a large rural area for truck models but then a smaller urban area for sedans. This type of setup makes it impossible to accomplish.

- It makes it more difficult to examine the performance of each model. Vendors often only report at the campaign level which would hide the breakdown by model. This averages out as an aggregate and can help hide poor performing models / ad groups.

- It makes it more difficult to create hyper-relevant ads which leads to low quality scores and subsequently higher costs and lower performance. Vendors are forced to throw all of their keywords for a particular model in a single ad group and implement more generic ads….instead of segmenting the keywords out by intent across multiple ad groups and creating more relevant ads.

What should you do?

Each model or model grouping should ideally have its own campaign with highly relevant segmented ad groups. This allows you more control over budget, geo targeting, keyword targeting, etc.

Example:

- Campaign: Chevrolet Silverado

- Ad Group: General

- Ad Group: Lease

- Ad Group: For Sale

- Ad Group: Specials

- Ad Group: Discounts

- Ad Group: APR

- Campaign: Chevrolet Malibu

- Ad Group: General

- Ad Group: Lease

- Ad Group: For Sale

- Ad Group: Specials

- Ad Group: Discounts

- Ad Group: APR

- etc...

The vendor had every model in a single campaign which gave them no control over the spend of each individual model.

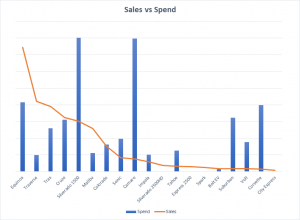

One of the things we look at is our annual sales volume vs our annual paid search spend for each model to quickly see if anything is way out of whack.

In the chart below, the orange line is our annual unit sales and the blue bars are the annual paid search spend.

You'll notice we spent way too much money on the Camaro, Suburban, Volt, and Corvette but not enough money on the Equinox, Traverse, and Trax. Why did this vendor spend $6,000 advertising the Corvette when we only sold 3 the entire year and probably would have sold them with zero paid search advertising.

This is a report everyone can easily run using Microsoft Excel to help identify wasted spend and areas of opportunity.