- Jul 30, 2009

- 103

- 14

- First Name

- Nick

Carvana spends $22M on a better VDP (via acquisition of Car360) but isn't making money.

Dealers and OEM's have the cars and are making money... but are valued lower than the tech companies.

WHY?? (Did you know that in 2017 Ford made almost $7B but was valued less than Tesla... who lost $2B last year?)

Data and potential audience.

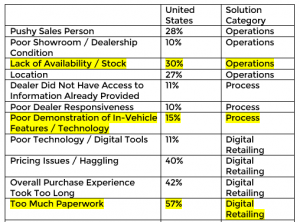

There's an interesting 2018 Deloitte study about what car customers don't like in their experience. I broke it into "Operations", "Process" and "Digital Retailing" and attached it here. The results are surprising. How many times have you heard, "my website sucks" (11% of customers didn't like digital tools) or "my process sucks" (10% of customers said that was true).

Our in-the-trenches perception does not necessarily match consumers.

This acquisition makes sense because:

1) Augmented reality will become a growing force across all industries this and upcoming years. The portability and accessibility will be critical and the Car360 seems to make sense when considering the potential there (if their technology actually produces a 3d model, at least)

2) Apps collect a lot of data for personal and shopping behaviors that can be used elsewhere. This would give a solid reason to install the application (imagine being able to physically step inside the used vehicle, from your home)

3) International markets don't necessarily have the cars you can drive off the lot with today (ex: Vive, a leading provider of virtual reality hardware has built VR Shops with 5 major manufacturers overseas)

However... in the US dealers have the cars today. There's no reason they can't continue to win in profit and volume if they're paying attention.

- Virtual reality can highlight those in-vehicle features and technology that customers care enough to pay more for but are not shown in a physical test drive.

- Augmented reality can be used to enable customers to shake the GM/dealers hand and hear why to buy from them

- Those immersive experiences enable good technology companies to watch and learn what customer trends are important in selling more cars, faster and can translate that into actionable insights for dealers including aftermarket upsells

Dealers and OEM's have the cars and are making money... but are valued lower than the tech companies.

WHY?? (Did you know that in 2017 Ford made almost $7B but was valued less than Tesla... who lost $2B last year?)

Data and potential audience.

There's an interesting 2018 Deloitte study about what car customers don't like in their experience. I broke it into "Operations", "Process" and "Digital Retailing" and attached it here. The results are surprising. How many times have you heard, "my website sucks" (11% of customers didn't like digital tools) or "my process sucks" (10% of customers said that was true).

Our in-the-trenches perception does not necessarily match consumers.

This acquisition makes sense because:

1) Augmented reality will become a growing force across all industries this and upcoming years. The portability and accessibility will be critical and the Car360 seems to make sense when considering the potential there (if their technology actually produces a 3d model, at least)

2) Apps collect a lot of data for personal and shopping behaviors that can be used elsewhere. This would give a solid reason to install the application (imagine being able to physically step inside the used vehicle, from your home)

3) International markets don't necessarily have the cars you can drive off the lot with today (ex: Vive, a leading provider of virtual reality hardware has built VR Shops with 5 major manufacturers overseas)

However... in the US dealers have the cars today. There's no reason they can't continue to win in profit and volume if they're paying attention.

- Virtual reality can highlight those in-vehicle features and technology that customers care enough to pay more for but are not shown in a physical test drive.

- Augmented reality can be used to enable customers to shake the GM/dealers hand and hear why to buy from them

- Those immersive experiences enable good technology companies to watch and learn what customer trends are important in selling more cars, faster and can translate that into actionable insights for dealers including aftermarket upsells