- Apr 7, 2009

- 4,984

- 2,424

- Awards

- 10

- First Name

- Joe

I'll not offering anything... I wouldn't spend the time or effort...

I'll not offering anything... I wouldn't spend the time or effort...

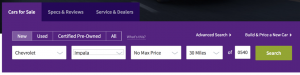

Note: The SRP search facets are on the bottom of the page

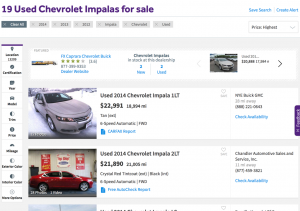

We don't know if we're seeing a split test or a launch of new UI. If it's a split test, this may be an ongoing affair, meaning the historical data you're looking at can have all kinds of UI variations in it.

gsvtht nThere seems to be something going on with Cars.com stats since the change to their new site layout. I help about 2 dozen dealerships in all different markets and they all carry different franchises and I am seeing the same trends at these stores.

I want to open up this conversation to see if anyone else is seeing the same trends?

I'm seeing a big drop in SRPs and VDPs, and not just on an overall drop but on a per car drop also.

Chart 1 shows a drop in weekly projected SRPs for this dealership's inventory.

Chart 2 shows the same dealerships weekly drop in projected VDPs.

Chart 3 shows the drop in those VDPs on a per car basis.

View attachment 2803

View attachment 2805

View attachment 2804

As you can see by comparing the trends to their Autotrader stats, it's not an inventory issue because if that were the case, both Autotrader and Cars.com would have dropped at the same level.

(these are charts created in Google Drive for our clients, the projected data is pulled out of vAuto’s Merchandising tool that gets a feed from Cars.com and the monthly data comes from Cars.com and Autotrader.com backend tool)

I'm also seeing a drop in VDP conversion percentage.

View attachment 2806

View attachment 2807

I'm also tracking a drop in leads coming to the stores.

View attachment 2808

View attachment 2809

All of this is coming at a time of the year where there is usually a spike in shoppers on both Autotrader.com and Cars.com. The months of January, Febuary and March show the largest shopper count year over year on Autotrader.com and Cars.com as you can see from the charts below..

View attachment 2810

View attachment 2811

Anyone else is seeing the same trends?

I noticed the same thing a few weeks ago and asked our cars.com rep to investigate. He came back with comments about inventory levels, picture, etc none of which had changed significantly. They seem to be more mobile focused could it be they are not picking up hits from mobile devices?There seems to be something going on with Cars.com stats since the change to their new site layout. I help about 2 dozen dealerships in all different markets and they all carry different franchises and I am seeing the same trends at these stores.

I want to open up this conversation to see if anyone else is seeing the same trends?

I'm seeing a big drop in SRPs and VDPs, and not just on an overall drop but on a per car drop also.

Chart 1 shows a drop in weekly projected SRPs for this dealership's inventory.

Chart 2 shows the same dealerships weekly drop in projected VDPs.

Chart 3 shows the drop in those VDPs on a per car basis.

View attachment 2803

View attachment 2805

View attachment 2804

As you can see by comparing the trends to their Autotrader stats, it's not an inventory issue because if that were the case, both Autotrader and Cars.com would have dropped at the same level.

(these are charts created in Google Drive for our clients, the projected data is pulled out of vAuto’s Merchandising tool that gets a feed from Cars.com and the monthly data comes from Cars.com and Autotrader.com backend tool)

I'm also seeing a drop in VDP conversion percentage.

View attachment 2806

View attachment 2807

I'm also tracking a drop in leads coming to the stores.

View attachment 2808

View attachment 2809

All of this is coming at a time of the year where there is usually a spike in shoppers on both Autotrader.com and Cars.com. The months of January, Febuary and March show the largest shopper count year over year on Autotrader.com and Cars.com as you can see from the charts below..

View attachment 2810

View attachment 2811

Anyone else is seeing the same trends?

Note: The SRP search facets are on the bottom of the page

...I'm beginning to think it's maybe a tagging or tracking issue, could even be with mobile devices too.

Yes, that's a total anomaly, I think it's a few things with shoppers; it's about trust, not really knowing market pricing (what's good or bad deal?), knowing the inventory rapidly changes, or actually how these car shopping sites work.-----SIDEBAR-----

It amazes me how few car shoppers visit car dealer websites via 3rd party aggregator VDP links.