- May 1, 2005

- 4,550

- 1,831

- Awards

- 12

- First Name

- Jeff

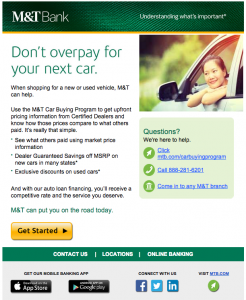

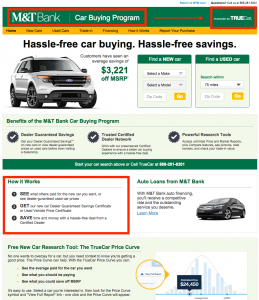

Nationwide Bank announced a partnership with TrueCars to provide a service that is designed to provide consumers with a "single stop" for their next vehicle purchase.

The service is to allow customers to find a vehicle, secure its price, get a loan and acquire auto insurance - ALL WITH ONE STOP

They've even coined it as Car Buying Reinvented !!

In a poll of 1,000 car buyers, Nationwide found that 25 percent thought car buying was as stressful as preparing their taxes. The highest stressors were negotiating price and obtaining financing, and 62 percent of respondents said they believed the dealership wasn’t going to give them the best price.

Through Nationwide’s partnership with TrueCar, an online car-buying service that allows users to compare dealerships’ prices and lock in the best deal, customers can search for cars at dealerships in their area. Once you find a car at the price you want, you can explore financing options with tools that show you what your monthly payment would be based on the loan’s term and the amount of your down payment, until you reach a loan agreement. Read even more here..

Could this be a growing trend with Banks and Financial Services?

The service is to allow customers to find a vehicle, secure its price, get a loan and acquire auto insurance - ALL WITH ONE STOP

They've even coined it as Car Buying Reinvented !!

In a poll of 1,000 car buyers, Nationwide found that 25 percent thought car buying was as stressful as preparing their taxes. The highest stressors were negotiating price and obtaining financing, and 62 percent of respondents said they believed the dealership wasn’t going to give them the best price.

Through Nationwide’s partnership with TrueCar, an online car-buying service that allows users to compare dealerships’ prices and lock in the best deal, customers can search for cars at dealerships in their area. Once you find a car at the price you want, you can explore financing options with tools that show you what your monthly payment would be based on the loan’s term and the amount of your down payment, until you reach a loan agreement. Read even more here..

Could this be a growing trend with Banks and Financial Services?