- Apr 7, 2009

- 4,985

- 2,425

- Awards

- 10

- First Name

- Joe

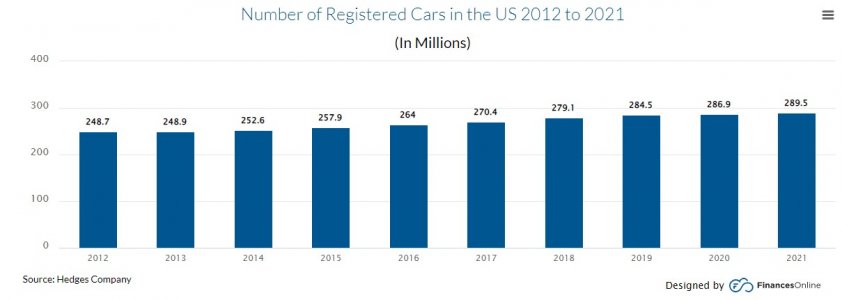

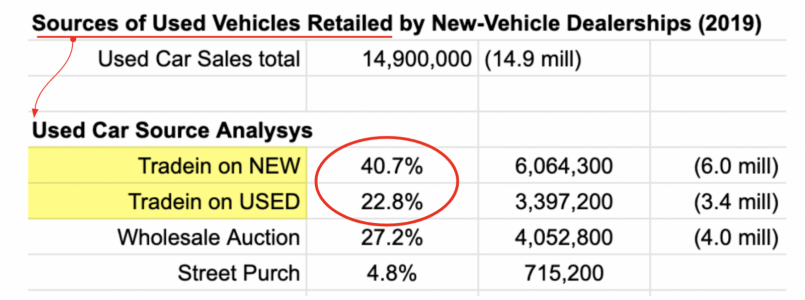

VIN's are on a conveyor belt. New car buyers use their car for 2-5 years and that VIN gets traded and becomes a used car. That used VIN gets used for 2-5 years and gets traded (or sold). That VIN keeps moving down the conveyor belt, from retailer to retailer, from seller to buyer.

COVID came to us in March of 2020 and that decline in sales volume is coming down the conveyor belt. We're 27 months into COVID, and we've got a Used Car Desert that's just about to show itself in used car prices. Guess who is going to get hit the hardest by this reduced supply of 'like new, used cars?'. The Wall Street used car titans, CarMax, Carvana, EchoPark, Vroom and all of the stand alone used car stores selling like new used cars.

Just over the horizon is the return of new car supply. The Used Car Desert will cause The Wall Street used car titans, CarMax, Carvana, EchoPark, Vroom to make an effort to 'steal the trade-ins'.

Thoughts?

COVID came to us in March of 2020 and that decline in sales volume is coming down the conveyor belt. We're 27 months into COVID, and we've got a Used Car Desert that's just about to show itself in used car prices. Guess who is going to get hit the hardest by this reduced supply of 'like new, used cars?'. The Wall Street used car titans, CarMax, Carvana, EchoPark, Vroom and all of the stand alone used car stores selling like new used cars.

Just over the horizon is the return of new car supply. The Used Car Desert will cause The Wall Street used car titans, CarMax, Carvana, EchoPark, Vroom to make an effort to 'steal the trade-ins'.

Thoughts?