My friend Larry Bruce posted “Why ZMOT is BS” onto a number of sites. Of course this immediately drew the ire of the ZMOT advocates. I contend both sides are right, and also wrong.

What is ZMOT?

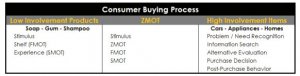

ZMOT is a concept that Google came up with a few years ago. Their VP of US Sales, Jim Lecinski, recently wrote an eBook titled “Winning the Zero Moment of Truth” describing the concept. It appears as though the aim of ZMOT was to convince marketers of what used to be thought of as impulse items, that their buyers were doing research before the purchase in a way they had never seen before. Here is what the Consumer Behavior models look like:

Why ZMOT is stupid – for automotive marketers

ZMOT starts, using as a foundation, the 3 step behavior model in place for decades when folks bought cheap impulse items… and then adds a fourth step. The problem is that the process for high-involvement items (like cars) was documented by folks who dedicated their lives to the study of consumer behavior decades ago as well. Hundred of textbooks, thousands of pages have been dedicated to this study. It is already well defined and was NEVER the 3-step model; it’s always been the 5-stage model. ZMOT takes it a giant step backwards from the Five Stages of Consumer Buying Behavior for a number of reasons.

Here’s an example of where ZMOT can lead us astray; ZMOT advocates view much (all?) traditional advertising as “Stimulus”. But very little automotive advertising is actually “Stimulus”. Stimulus is the billboard you drive by on the highway that makes you think “Yeah, pizza does sound good tonight”. Most automotive billboards, on the other hand are designed with a strong branding component rather than stimulus. They are also in place to raise awareness of the dealership after a need has been recognized – to add the dealership to the customer’s consideration set. Branding can be a big factor in the high-involvement Purchase Decision stage. Having a strong brand can tip the scales in your favor at ‘ZMOT’.

With high-involvement products it’s almost impossible to spark the need, but advertising can be very influential in the Information Search and Alternative Evaluation stages. The ZMOT folks see traditional advertising as Stimulus because the ZMOT model starts with Stimulus (many times external) – the automotive buying model doesn’t. It starts with recognition of a need (almost always internal). While much of the automotive buyer’s research is done online, the factors that contribute to the Purchase Decision aren’t limited to the Internet. The strong brand a dealer has created offline will come into play at the online ZMOT.

So here’s the problem, ZMOT’s foundation is the wrong buying process – the buying process for chewing gum, pizza and pantyhose, one that goes from Stimulus to Purchase Decision. It’s added a step for sure, but when you’re marketing a car dealership at a high level, your foundation needs to be more advanced.

If you look to the 5-stage model, you’ll see that traditional advertising isn’t inherently a bad thing, but you’ll understand exactly how it influences consumers. That said you’ll also recognize the vital importance to a consistent branding and cohesive messaging.

Here’s Jim Lecinski, when asked if he thought ZMOT changes the buying decision:

Consumers have always followed a much more advanced model with auto purchases.

Why ZMOT is Brilliant

Way too few folks in the dealership world have a strong foundation in marketing. The birth of the Internet hasn’t helped. It’s focused dealers on the First Moment of Truth, the Purchase Decision. Whether we call it conversion, a lead or an “up”, we put all our focus on one stage. ZMOT delves into how we should be looking at all 5 Stages (or 4 if you wish to use the ZMOT model). If you do focus on the entire process, you WILL sell more cars. I’ll still contend that the Zero Moment of Truth is nothing new, but I fully agree that the more attention paid by dealers to the traditional 2rd and 3rd stages (ZMOT), the better off they will be.

And ZMOT is brilliant because it does just that. If a catchy little acronym is what it takes to get dealers to pay attention to the entire process – the entire cycle – then the dealers will be the winners.

This little eBook from Google and its advocates have sparked dealers’ interest in Consumer Behavior. Marketing, at its core, is about so much more than where you spend your money – it’s about having a better understanding of your consumer. ZMOT may well be the most important thing to happen to automotive marketing in a long while.

The Solution

Use the ZMOT concept to wake your dealership up but don’t base your entire marketing plan on an eBook written by the guy Google has in charge of selling you AdWords. Dust off your old marketing textbooks and dive into them. If you’ve never actually studied marketing, take a class or two. Do some reading. Study concepts like Purchase Intent, Awareness, Branding, Consideration Set and the like. They will serve you well in your quest to win the ZMOT.

The core foundation of your ZMOT efforts should be the proven Five Stages of Consumer Buying Behavior and not the behavior of folks buying bubble gum. From what Jim Lecinski says, he based ZMOT on the consumer behaviors that have always been at play with auto sales, he just dumbed it down a little for folks selling gum. Go back to the original material on which he based ZMOT. (he does have a Masters Degree in marketing, he knows what he’s talking about)

And one last bit of advice: Don’t just optimize for the sale, optimize for the research.

What is ZMOT?

ZMOT is a concept that Google came up with a few years ago. Their VP of US Sales, Jim Lecinski, recently wrote an eBook titled “Winning the Zero Moment of Truth” describing the concept. It appears as though the aim of ZMOT was to convince marketers of what used to be thought of as impulse items, that their buyers were doing research before the purchase in a way they had never seen before. Here is what the Consumer Behavior models look like:

Why ZMOT is stupid – for automotive marketers

ZMOT starts, using as a foundation, the 3 step behavior model in place for decades when folks bought cheap impulse items… and then adds a fourth step. The problem is that the process for high-involvement items (like cars) was documented by folks who dedicated their lives to the study of consumer behavior decades ago as well. Hundred of textbooks, thousands of pages have been dedicated to this study. It is already well defined and was NEVER the 3-step model; it’s always been the 5-stage model. ZMOT takes it a giant step backwards from the Five Stages of Consumer Buying Behavior for a number of reasons.

Here’s an example of where ZMOT can lead us astray; ZMOT advocates view much (all?) traditional advertising as “Stimulus”. But very little automotive advertising is actually “Stimulus”. Stimulus is the billboard you drive by on the highway that makes you think “Yeah, pizza does sound good tonight”. Most automotive billboards, on the other hand are designed with a strong branding component rather than stimulus. They are also in place to raise awareness of the dealership after a need has been recognized – to add the dealership to the customer’s consideration set. Branding can be a big factor in the high-involvement Purchase Decision stage. Having a strong brand can tip the scales in your favor at ‘ZMOT’.

With high-involvement products it’s almost impossible to spark the need, but advertising can be very influential in the Information Search and Alternative Evaluation stages. The ZMOT folks see traditional advertising as Stimulus because the ZMOT model starts with Stimulus (many times external) – the automotive buying model doesn’t. It starts with recognition of a need (almost always internal). While much of the automotive buyer’s research is done online, the factors that contribute to the Purchase Decision aren’t limited to the Internet. The strong brand a dealer has created offline will come into play at the online ZMOT.

So here’s the problem, ZMOT’s foundation is the wrong buying process – the buying process for chewing gum, pizza and pantyhose, one that goes from Stimulus to Purchase Decision. It’s added a step for sure, but when you’re marketing a car dealership at a high level, your foundation needs to be more advanced.

If you look to the 5-stage model, you’ll see that traditional advertising isn’t inherently a bad thing, but you’ll understand exactly how it influences consumers. That said you’ll also recognize the vital importance to a consistent branding and cohesive messaging.

Here’s Jim Lecinski, when asked if he thought ZMOT changes the buying decision:

“No, ZMOT was an attempt to catalogue, characterize and give a sticky name to the behaviors that we are seeing from consumers. What is new on a consumer-behavior front is that consumers who used to use this Zero Moment research model to inform their buying decisions only around high-ticket or so-called high-involvement products -- white goods, cars or travel -- are now so comfortable with and reliant on that behavior that they are now applying it to what you would call everyday items.”

Consumers have always followed a much more advanced model with auto purchases.

Why ZMOT is Brilliant

Way too few folks in the dealership world have a strong foundation in marketing. The birth of the Internet hasn’t helped. It’s focused dealers on the First Moment of Truth, the Purchase Decision. Whether we call it conversion, a lead or an “up”, we put all our focus on one stage. ZMOT delves into how we should be looking at all 5 Stages (or 4 if you wish to use the ZMOT model). If you do focus on the entire process, you WILL sell more cars. I’ll still contend that the Zero Moment of Truth is nothing new, but I fully agree that the more attention paid by dealers to the traditional 2rd and 3rd stages (ZMOT), the better off they will be.

And ZMOT is brilliant because it does just that. If a catchy little acronym is what it takes to get dealers to pay attention to the entire process – the entire cycle – then the dealers will be the winners.

This little eBook from Google and its advocates have sparked dealers’ interest in Consumer Behavior. Marketing, at its core, is about so much more than where you spend your money – it’s about having a better understanding of your consumer. ZMOT may well be the most important thing to happen to automotive marketing in a long while.

The Solution

Use the ZMOT concept to wake your dealership up but don’t base your entire marketing plan on an eBook written by the guy Google has in charge of selling you AdWords. Dust off your old marketing textbooks and dive into them. If you’ve never actually studied marketing, take a class or two. Do some reading. Study concepts like Purchase Intent, Awareness, Branding, Consideration Set and the like. They will serve you well in your quest to win the ZMOT.

The core foundation of your ZMOT efforts should be the proven Five Stages of Consumer Buying Behavior and not the behavior of folks buying bubble gum. From what Jim Lecinski says, he based ZMOT on the consumer behaviors that have always been at play with auto sales, he just dumbed it down a little for folks selling gum. Go back to the original material on which he based ZMOT. (he does have a Masters Degree in marketing, he knows what he’s talking about)

And one last bit of advice: Don’t just optimize for the sale, optimize for the research.