You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CarGurus vs Carfax - Good and Great _or_ Great and Good?

- Thread starter DrewAment

- Start date

- May 1, 2006

- 3,612

- 2,547

- Awards

- 13

- First Name

- Alex

- May 1, 2005

- 4,501

- 1,788

- Awards

- 12

- First Name

- Jeff

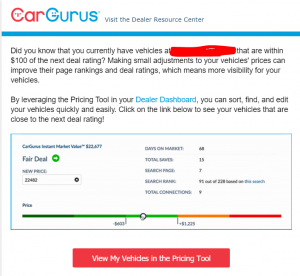

@DrewAment you actually bring up a great point. In the scramble to align with shoppers, the Classifieds take it upon themselves to be the expert in making sure the customer knows the dealer isn't ripping them off. In their efforts they risk confusing the shopper further by cementing that the term "Market" is a moving target. Here is an example within our own inventory:

2017 Mazda Mazda6 Touring 24k miles - Provision 97% Mkt and 11 days old priced at $17,000

Cars.com = Good Deal with no added comment regarding "Why"

CarGurus = Fair Deal with added comment of $442 Below Market

CarFax = Fair Value with added comment of $140 Above CarFax Value (CarFax had to be different and use Blue to state this?)

Edmunds.com = Fair Deal with added comment of $349 Below Market

AutoTrader/KBB.com = Great Price with no added comment as to "Why" (if I value as a shopper in KBB value tool, "Typical Listing Price (CPO)" is $18,743 and "Fair Market Range (CPO)" is $16,665-$19,820)

TrueCar = Great Price with added comment of $304 off avg. list price

Shoppers may have more data at their fingertips but they sure are overloaded with "Expert" shopping advice from sources that don't buy and sell cars... Does anyone have insight to the market values each is running? Obviously KBB/AutoTrader is running their own Cox family values.

2017 Mazda Mazda6 Touring 24k miles - Provision 97% Mkt and 11 days old priced at $17,000

Cars.com = Good Deal with no added comment regarding "Why"

CarGurus = Fair Deal with added comment of $442 Below Market

CarFax = Fair Value with added comment of $140 Above CarFax Value (CarFax had to be different and use Blue to state this?)

Edmunds.com = Fair Deal with added comment of $349 Below Market

AutoTrader/KBB.com = Great Price with no added comment as to "Why" (if I value as a shopper in KBB value tool, "Typical Listing Price (CPO)" is $18,743 and "Fair Market Range (CPO)" is $16,665-$19,820)

TrueCar = Great Price with added comment of $304 off avg. list price

Shoppers may have more data at their fingertips but they sure are overloaded with "Expert" shopping advice from sources that don't buy and sell cars... Does anyone have insight to the market values each is running? Obviously KBB/AutoTrader is running their own Cox family values.

- Apr 20, 2009

- 692

- 694

- Awards

- 8

- First Name

- Ryan

Hey @Dan Sayer,

CarStory does a lot of work in this space. We've been at it for 15 years and no offense to some of the players listed, but I'm not surprised to see the shotgun pattern above. Determining valuation is very complicated. It starts with a large, clean dataset. At a minimum, you need:

The next tunnel to explore is trade-in values and instant cash offers. Put your consumer hat on and get ready to be extremely underwhelmed by the current state of this critical component of true digital retailing.

The next tunnel to explore is trade-in values and instant cash offers. Put your consumer hat on and get ready to be extremely underwhelmed by the current state of this critical component of true digital retailing.

FWIW, Vroom had a pretty good day yesterday after their IPO. That wasn't entirely about their "sales" model in my opinion. Inventory acquisition strategy and execution matters too.

CarStory does a lot of work in this space. We've been at it for 15 years and no offense to some of the players listed, but I'm not surprised to see the shotgun pattern above. Determining valuation is very complicated. It starts with a large, clean dataset. At a minimum, you need:

- A complete set of inventory - the more you have, the better the output.

- Accurate vehicle data - VIN decode only tells part of the story. To compare apples-to-apples, you need a complete and accurate description of the vehicle.

- Similarity algorithm - You need to develop an understanding of which cars are truly similar to one another. This step is critical and more complex than I can explain in a single line. Suffice to say, it was hard enough to do that we patented it after we figured it out.

- True Data Science - I can use Martha Stewart's recipe and match the ingredients and not bake a very good cake. We see a lot of vendors use simple averages. That might have been good enough ten years ago, but it is not today.

The next tunnel to explore is trade-in values and instant cash offers. Put your consumer hat on and get ready to be extremely underwhelmed by the current state of this critical component of true digital retailing.

The next tunnel to explore is trade-in values and instant cash offers. Put your consumer hat on and get ready to be extremely underwhelmed by the current state of this critical component of true digital retailing. FWIW, Vroom had a pretty good day yesterday after their IPO. That wasn't entirely about their "sales" model in my opinion. Inventory acquisition strategy and execution matters too.

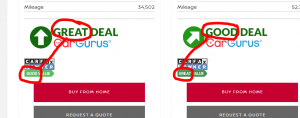

Are we chasing deal bades?? And why is the vender pushing this so hard??

And if we are, what are the criteria used to get a Great/Good, etc. As @Dan Sayer pointed out - none of them have a deep discussion of why, or the dataset, or the validation they are using to make that decision.

.

.

.

And if we are, what are the criteria used to get a Great/Good, etc. As @Dan Sayer pointed out - none of them have a deep discussion of why, or the dataset, or the validation they are using to make that decision.

.

.

.

- May 1, 2005

- 4,501

- 1,788

- Awards

- 12

- First Name

- Jeff

- Oct 25, 2019

- 7

- 3

- First Name

- Guy

@DrewAment you actually bring up a great point. In the scramble to align with shoppers, the Classifieds take it upon themselves to be the expert in making sure the customer knows the dealer isn't ripping them off. In their efforts they risk confusing the shopper further by cementing that the term "Market" is a moving target. Here is an example within our own inventory:

2017 Mazda Mazda6 Touring 24k miles - Provision 97% Mkt and 11 days old priced at $17,000

Cars.com = Good Deal with no added comment regarding "Why"

CarGurus = Fair Deal with added comment of $442 Below Market

CarFax = Fair Value with added comment of $140 Above CarFax Value (CarFax had to be different and use Blue to state this?)

Edmunds.com = Fair Deal with added comment of $349 Below Market

AutoTrader/KBB.com = Great Price with no added comment as to "Why" (if I value as a shopper in KBB value tool, "Typical Listing Price (CPO)" is $18,743 and "Fair Market Range (CPO)" is $16,665-$19,820)

TrueCar = Great Price with added comment of $304 off avg. list price

Shoppers may have more data at their fingertips but they sure are overloaded with "Expert" shopping advice from sources that don't buy and sell cars... Does anyone have insight to the market values each is running? Obviously KBB/AutoTrader is running their own Cox family values.

@Dan Sayer What zip code is your Mazda for sale in? I could tell you what the average price/miles/days on market for any similar vehicles is within a certain miles radius. I can also tell you what those averages were for similar vehicles that sold in the last 90 days in that radius.

Does anyone know if any of these valuation tools use the location of the vehicles in their valuations?

@GuyCampbell we use Provision by vAuto so have that data figured within our price strategies for each market. As for vendors, I would say with 99% confidence they all figure their price validation by geo.@Dan Sayer What zip code is your Mazda for sale in? I could tell you what the average price/miles/days on market for any similar vehicles is within a certain miles radius. I can also tell you what those averages were for similar vehicles that sold in the last 90 days in that radius.

Does anyone know if any of these valuation tools use the location of the vehicles in their valuations?