Hi

@Dan Sayer,

@DrewAment - yes I can give a little detail. To help dealers as much as we can during these unusual times, we're focusing on two primary goals: protect the shopping experience for consumers, and protect marketing performance for our paying subscribers.

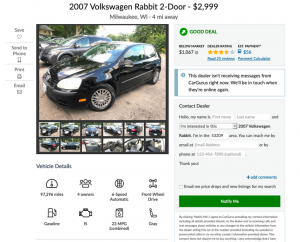

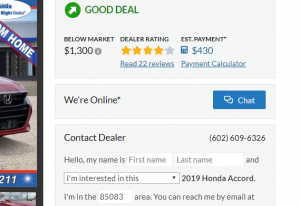

To protect the shopping experience, we want to make sure it's clear to shoppers whether or not they can get in touch with the dealer when they're looking at a car. For our paying customers, we have a good understanding of that: they either took the 50% discount for April and May are continuing to get leads and build up a pipeline, or they stopped their subscription and moved into our free segment.

It's less clear for dealers who

started in our free segment. Since they're not paying us, they're not likely to let us know if they're closed. That could create a bad user experience, since shoppers won't know the dealer isn't available.

As a result, we moved all non-paying users into this new suspended status. We'll make sure consumers understand they won't be getting responses right away.

The key way we're protecting our paused subscribers is queuing up leads for when they reactivate their subscription. In normal times, those queued leads wouldn't be as valuable as real-time leads -- but in a situation where neither the dealer nor the shopper can complete a transaction, they're worth something. In areas where dealers are shut down, by law or by choice, these shoppers won't be able to complete a purchase -- they're shopping now because they have time on their hands, but they can't actually complete the transaction. In those cases, paused leads will still have value: two thirds of car purchases are need-based, and those needs won't have been met in the meantime.

We're hoping this temporary change will be brief and we can all get back to business sooner rather than later. In the meantime, stay safe and stay home.