Glad you brought up real estate, it's a high value item, and I think it might be a similar philosophy.There's plenty of financing estimates in other industries as well. I'm shopping for houses, and both the Zillow and Trulia app ask about my credit score so that I can get an estimated monthly payment from every house I look at. It's estimated, and houses have plenty of other factors that go into payment options, but it gives me an estimate and a comparable number that I can at least attempt to plan around myself.

I would imagine that thought process is very evident given the increasing importance of the internet.

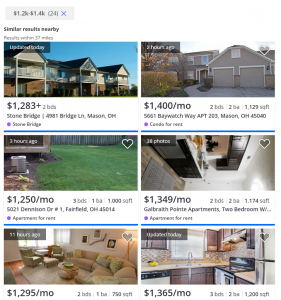

Just a simple search on rentals in a zip code with a payment range on zillow.

There it is, I'll go look at places to rent now.

Yeah payments flux a tad, I'll deal with it.

Need to make sure it's what I want.

Now I'll spend how much time online shopping, browsing content?

Please Choose an Option Below:

+1) 2 hours

+2) 6 hours

+3) 12 hours

+4) Enough to pick a few nice deals to visit nearby.

That's a lot of time at any option, with many layers of valuable interaction to be educated on the market with the content.

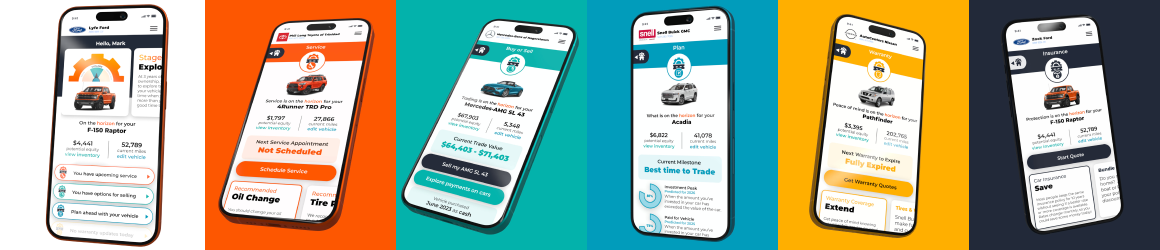

Leasing vehicles would be interesting here as far as the display and filtering options below.