Great questions Kelly.

Joe, do you feel that customers ever answered a question a certain way because they felt it was expected of them? ...

Yes. I carefully considered this. A survey done pre-sale is a fail. Their guard is way up and the sales rep feels the questions put the shopper into full defense mode. Post-sale, near delivery, the game is over, the shopper is all warm and fuzzy and the shopper's guard is nearly gone.

(note: This is the core reason why a CRM that asks a walk in for a lead source is a total fail.)

...We did a study with a local ad source [tv/digital/paper] the answers didn't match what I see online or what any of the "automotive research" shows. Given the grain of salt due the source, post activity reflection still seems skewed. Thought the "right questions" can help, how did/do you account for this in taking action on the data you collect?

The shoppers journey is a looooong and complicated trip. It lasts several weeks or months, the shopper is exposed to hundreds of auto marketing messages and dozens of websites AND its NOT a clean and linear path. Our shopper goes in-market on tuesday, then vanishes for 3 weeks and is back in-market again (they saw a tv ad, or their odo hit 50,000 and they're back looking at cars again).

The survey has to embrace this reality and keep it's questions high level (i.e. "when you were car shopping, where did you look to get ideas? TV, Radio, NewsPaper, Internet, Magazine, ....(check all that apply) "

You can't ask them: "Did you see any of our cars on: Cars.com, Autotrader.com, LocalNewsPapersite.com, etc...(check all that apply)" You can't ask them "Where did you see the car you bought?" The shopping journey is way too complex and foggy to get these answers, so the shopper will not want to appear ignorant and will plug in answers as needed.

The mission here is to create a profile of the shopper's habits, a top level look at how they go about their STEALTH shopping.

A few take-aways should look like:

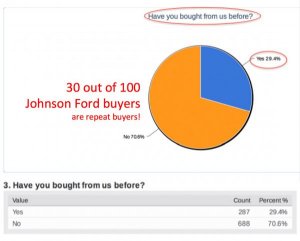

Whats my referral biz look like (friends and family)

Where's my store in the shoppers buying journey? Do I get the easy "one store closes", or, do I get shoppers that are grinders and bouncing from store to store? (note: this is complex, it's influenced by your stores profile and your position in the marketplace. It is influenced by your franchise, your inventory profile (width & depth), your Geo (relative to the major market), TV spending, Digital spending, web marketing & merchandising, your stores sales skills, etc...)

What influence does used car shopping have on my shoppers mix? (i.e. do my shoppers look for new and used simultaneously? If so, what merchandising efforts do I make on the site and on the lot to address this?")

Do shoppers visit my site?

--if so, why and how often do they look at it? (just how important is our site to the shopper?)

Some of the best take aways from the survey can be sent right back to all the decision makers and the sales team. Like...

Do my shoppers consider themselves frequent internet users?

--if so, can someone shove this survey in the face of the UC manager, so he/she'll to stop blowing their ad spend on newsprint!

How long do OUR shoppers take before they buy a car?

--Show this to the ENTIRE sales staff. Example could be: "50% of YOUR sales came from shoppers that we're in-market for longer than 4 weeks... Old does not mean cold! Give yourself a raise, WORK YOUR CRM"

My take aways...

I was marketing director, from my survey, I found the single greatest signature of a "sale in the making" was a shopper at my web site for a repeat visit. The "repeat visitor" stat became my obsession which lead me to build all kinds of awesome merchandising tools on my old site, including MyCars, Big ass Pics, LESS Lead Gen buttons AND putting them below the fold (satisfy the shopper 1st, lead gen will follow), Automatic comment generator, Hot Feature call outs, reverse transparency messaging, etc... In my case, once I had my merchandising game going, I ramped up PPC spending so I could fuel more repeat visits.