10 days, 29 websites & 10.5 hrs later... my brother is burning gas!

Shopper Overview:

My brother was a segment shopper (crossover SUV). His search criteria was: 'any crossover', most high tech toys (infotainment, safety systems), then price. He didn't have any anti-brand bias (i.e. "I won't buy a domestic'). He's your typical selfish shopper "I want the most for the least"

His prior SUV worked flawlessly, so he gave that brand preferential treatment

My take aways:

- He missed many research opportunities

- The Upslope is real

- YouTube was a closer

- Digital Retailing

#1). He missed many research opportunities

He under-explored "shopping by segment" and he under-explored trim/package/options opportunities. He relied on the content experts like Consumer Reports, Car & Driver & Motor Trend to drive his short list. The reason why he under-explored these 2 categories is because no site makes it easy for him to do it.

IMO, 3rd party sites like AT, Cars, cargurus, etc miss out on this opportunity. Not only can these sites help this shopper get deep into the details (if they want), but, when the shopper is way up on the top of the funnel, PRICE is almost always used simultaneously when evaluating ideas. IOW, 3rd party sites have the ability to incorporate real prices into the expert content.

#2). The Upslope is real

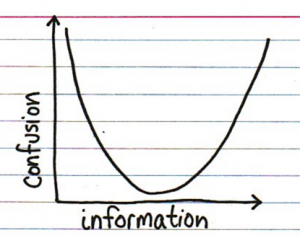

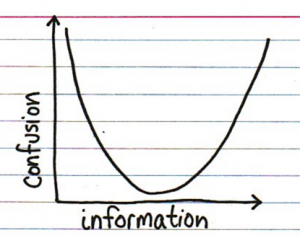

This chart* describes what it's like to shop for a car online.

I watched my brother start confused with little information (top left of chart). Then, as he invested time researching, he slid down the slope as he got more info and was less confused. Then, many websites later, I watched him spend more and more time researching but I could see him getting lost. HE WAS ON THE UPSLOPE. It was here that he kept asking me if there was a wizard that could guide him (IOW, the info he was gathering was making him more confused).

I saw it coming and wrote:

p.s. I see his conclusion coming as clear as day. He is going to be another shopper that will tire from the fragmented shopping UX and abandon the internet and go to the dealer to fill in the gaps. I see this behavior everywhere I look. It's why internet shoppers don't want Digital Retailing ...yet

*If you're as wacked as I am and and you want to explore this more, it's all over our forums and on the blog

http://forum.dealerrefresh.com/threads/my-bizzare-world.464/

#3). YouTube was a closer

My brother found independent reviews on youtube late in his car shopping journey. For him, the reviews reinforced his decision and reduced his concerns that he hadn't made his best effort to buy the right car. Remember, my brother's on the upslope, so these videos were exactly what he needed to move forward... with confidence.

Note: Shopping is a task & I'm all about workflow. Workflow is all about context. My brother was on the upslope. It would be interesting to see how youtube car reviews influences shoppers in different stages in the workflow (and factor in their personas)

If you're interested, I asked my brother to send me his youtube history, here it is:

<--cool dealer made video!

He used this to get his wife's interest

These were seen in 24hrs prior to the sale

#4). Digital Retailing

The day prior to the sale, my brother is stressing over time and schedules. He knows what he wants, the store he's going to buy it at. He's got a pre-arranged price from Consumer Reports/TrueCar. He's got a Black Book tradein value he likes. It's the end of the month and he's got to find a way to get it all done.

IS THERE A BETTER DIGITAL RETAILING CANDIDATE? Nope.

So I ask him, if you could buy it online right now, would you? He instantly answers "No... we haven't seen it yet. We haven't test driven it yet, what if I don't like the dealer?"

#BAM. There it is...

The benefits of a 'stress free ecommerce experience' are inferior to the benefits a dealer visit creates.

My Summary:

This user story contains all the nuance of what I see every day. When I build solutions, they are only as complex as the marketplace is. From a high level, I see internet shopping for a car is a cluster f**k and Digital Retailing's penetration rate is capped by a very complex journey that is not helped by an internet experience filled with gaps. Add to this the shoppers excitement of walking into a store and ending all this research.