- Apr 7, 2009

- 5,007

- 2,438

- Awards

- 10

- First Name

- Joe

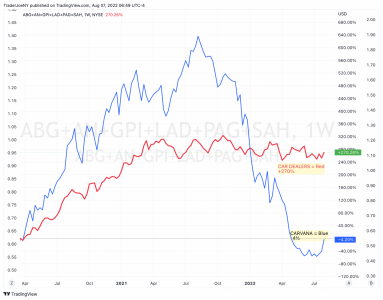

Back in June, I wrote:

The two charts in the prior post (gasoline, wholesale and retail) speak to the lag that exists in wholesale and retail prices, the same thing happens in used car retail, only far bigger and far more important. IMO, the shopper data seen in the big 3 marketplaces must be 'worked' as they can see into demand weeks before it becomes a sale.

Because used cars turn so slowly, buying the car right can make or break your P&L. Someone needs to build a far more robust vehicle pricing tool that 'sees' all of the data that human beings cannot see.

Used Car Volatility Index... someone needs to build this

Used Car Volatility Index... someone needs to build thisThe two charts in the prior post (gasoline, wholesale and retail) speak to the lag that exists in wholesale and retail prices, the same thing happens in used car retail, only far bigger and far more important. IMO, the shopper data seen in the big 3 marketplaces must be 'worked' as they can see into demand weeks before it becomes a sale.

Because used cars turn so slowly, buying the car right can make or break your P&L. Someone needs to build a far more robust vehicle pricing tool that 'sees' all of the data that human beings cannot see.

Last edited: