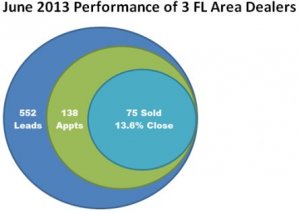

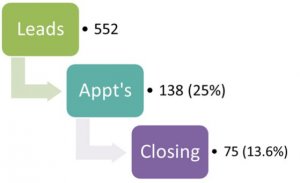

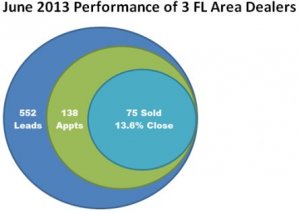

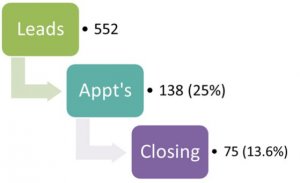

In an effort to respond to questions as fast as possible, I am going to share data as I get it in. Below is a look at three dealers who responded to my question, "How many leads, appointments, and sold units we derived from the Instant Pricer in June, 2013?".

This is only a one-month view, but as time goes on we can grow this lead analytic report. By combining three dealers we are looking at different sales abilities. While one of these dealers had a closing ratio close to 10%, another had an almost 19% closing ratio. I think this is a fair comparison by using dealers with different follow-up and phone sales abilities.

Why One Dealer Has A 19% Closing Ratio?

What we know regarding the dealer who has close to a 19% closing ratio is that they are calling the consumer more rapidly, and they are responding to the consumer with additional information regarding the vehicle inquiry. Additionally, since the consumer already has the price, the dealer sends the consumer payment and lease options along with available incentives and dealer advantages (why buys).

Here is the first response email with the dealer name and links left out:

Dear xxx,

My name is xxx, Internet Director at Toyota of xxx. I want to be sure you have all the information you need in regards to the 2013 Toyota Camry LE you inquired about.

You already saw our low XXX Price of $20,995 (MSRP $24,115), stock #xxx on our website with our Instant Price Program. Below is additional information I gathered for you on the 2013 Camry LE.

• Currently, Toyota is offering $1,000 cash back, or 0% APR for up to 60 months and $750 Toyota finance Cash on the 2013 Toyota Camry.

• There is a Toyota Lease Offer on the 2013 Toyota Camry LE for $199 per month. Click here to view our lease Offers.

• If you are currently enrolled in college or if you are a recent college grad, a first-time buyer, active or recently retired military, or if you are trading in your old vehicle, there may be additional offers available to you. Please call me to find out what you qualify for.

• Additionally, with the purchase of a new Toyota at XXX you get lifetime oil and filter changes, engine guarantee, installed parts, free car wash after service, and Virginia state inspections with our XXX Rewards Program!

By the way, you may be interested in this like-new 2011 Toyota Certified Used Camry LE for only $18,999 with less than 22,000 miles. Click here to view this vehicle.

Please call me at XXX, or if you come to the dealership, please ask for me, XXX.

Kind Regards,

Bad Leads

As far as the question, "How many, or what percent of the leads are bad leads?", the responses from these dealers came back with nearly the same answer (paraphrased): "No more than any other provider." What does that mean? I do not know; this is unknown.

Eventually we will get into dealer CRMs and look at things like bad leads, or buying time, etc. For now the answer for the number of bad leads is vague. I am sorry. In time we will provide those answers and other specific statistical information as we are actively seeking access to CRMs to look at these things.

Hopefully, this response is adequate for those who are asking.