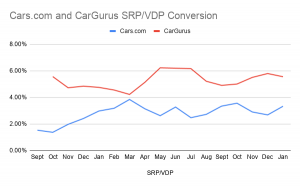

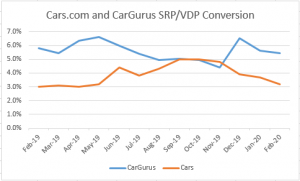

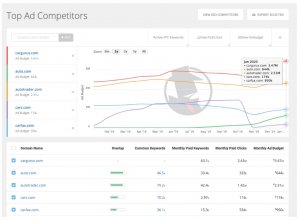

I've been tracking data from our 3rd Party Classifieds for a very long time and one of the (many) items I monitor is the SRP/VDP conversion. I feel this is one of the indicators of how well we are merchandising, pricing, etc our inventory. I've noticed this odd inverse relationship between Cars.com and CarGurus where if Cars.com SRP/VDP conversion raises, CG dips and if Cars.com falls, CG goes up. This is one of our stores in the Lincoln, NE market. The data below is USED Cars.com SRPs/VDPs vs CarGurus total SRP/VDP since they tell me 99% are USED.

Am I missing something? Is anyone else experiencing this? Obviously, these are the same cars with the same merchandising, etc so my theory on what information SRP/VDP conversion indicates about merchandising doesn't fly in this case. Math is total VDPs divided by total SRPs.

Am I missing something? Is anyone else experiencing this? Obviously, these are the same cars with the same merchandising, etc so my theory on what information SRP/VDP conversion indicates about merchandising doesn't fly in this case. Math is total VDPs divided by total SRPs.

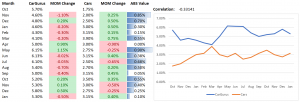

let alone go crazy over. That to me is >.60 or <-.60. The reason it is a weakish correlation is because you have to factor the significance of individual months change. The correlation of -0.33 factors this but I tired to represent it for you below in an easier way (since it is baked in).

let alone go crazy over. That to me is >.60 or <-.60. The reason it is a weakish correlation is because you have to factor the significance of individual months change. The correlation of -0.33 factors this but I tired to represent it for you below in an easier way (since it is baked in).