You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Latest activity

Filters

Show only:

Has anyone ever come across a reliable source that shows DMS market penetration?

- By Viracocha

- DMS Systems, Data, Security, I.T.

- 0 Replies

There are lots of sites that have quoted numbers, but they all appear to be marketing influenced and not necessarily an accurate view of actual North America penetration of just DMS product.

I have to assume its still >70% CDK and Reynolds with the rest being Tekion, PBS and Dealertrack?

Reynolds & Reynolds

- Reynolds states its products are in “over 70% of U.S. dealerships.”

If you (carefully) apply that to NADA’s 16,972 figure, that implies roughly ~11,900 U.S. dealerships—but this is products, not necessarily their DMS

CDK

- CDK states it’s “trusted by nearly 15,000 dealer locations.”

- Reuters also describes CDK as serving 15,000+ retail locations across North America.

Gap: neither source breaks that 15,000 into U.S. vs Canada, and “locations” may include more than just franchised light-vehicle rooftops.

I have to assume its still >70% CDK and Reynolds with the rest being Tekion, PBS and Dealertrack?

TAKE POLL Bidding on your own Dealership Name in Ads

- By Tallcool1

I personally feel that same as many in here, it is wasted money.

Social Media Marketing specific tactics

I’ve had good luck boosting prospect engagement by mixing real customer stories with quick behind-the-scenes clips from the service lane or delivery bays. Watching what shoppers interact with has been huge for me, and I’ve even used an instagram activity tracker to see which competitor posts spark the most likes and follows. It helps shape content that feels more human and gets people talking without overthinking things.

ONLY 7% of buyers report purchasing entirely online - Digital Retailing FAILED?

- By Mico Silver

- Vehicle Merchandising & Inventory Software

- 13 Replies

I do not see this correlation, DRT could be a great CTA and a conversion driver. Anything that provides real value to the customer (like a reliable payment calculator) is a net positive. The problem begins when the DRT data is unreliable, or when the tool is slowing down the website.In my experience, every OEM attempt at DR has reduced sales for dealers forced to add it to their websites with prominent CTAs. Short of being a one-price OEM (à la Tesla) or the undisputed low-price leader (willing to lose more money than the competition), there is little advantage for franchised dealers to add a DR tool meant to sell 100% online (which most of these tools don't do anyway).

ONLY 7% of buyers report purchasing entirely online - Digital Retailing FAILED?

- By Alex Snyder

- Vehicle Merchandising & Inventory Software

- 13 Replies

I was on a panel with a few prominent digital retail solutions a few years ago. Cox Automotive was on there. They said less than 5% of the customers who started the DR experience completed it. If the number is now 7%, that is a significant increase. However, I imagine 7% includes retailers like Tesla, Polestar, Rivian, and Carvana. That less than 5% form completion probably still applies to the traditional model.

Is DriveCentric just running away from the pack at this point?

- By elmagito

- CRM, ILM, Chat, Desking, Emails, Phone, SMS

- 10 Replies

Our owner and controller are out of town as Rey Rey invited them to see their new items and give a presentation on the whole package. We have used Reynolds DMS the old system with Power where we have to manually sent the inventory via FTP to DealerVault and DealerVault will sent to our inventory provider. This is archaic. What I am most afraid is they get brainwashed into accepting the CRM called Focus by Reynolds and move us out of DriveCentric. I will not believe that Reynolds has a better CRM that DriveCentric. They will not even show screenshots to the public. What are they afraid of?

I am also keep tabs with Gary Graves and Jack Behar in their new venture called DealerCX. These gentlemen I consider innovators.

I am also keep tabs with Gary Graves and Jack Behar in their new venture called DealerCX. These gentlemen I consider innovators.

ONLY 7% of buyers report purchasing entirely online - Digital Retailing FAILED?

- By Mico Silver

- Vehicle Merchandising & Inventory Software

- 13 Replies

First of all - 7% is much higher than I thought, I am curious if it includes Tesla and the like, and what it would be without it.

Second, I think that the OEM's carry a big chunk of responsibility. The tools that they build and push are simply inadequate. The one DRT that I am most familiar with - SmartPath/Monogram for Toyota/Lexus cannot even complete the whole purchase online, the F&I part is only in pilot stage, and it is run by a separate company - TFS, while the rest is run by TMNA.

Second, I think that the OEM's carry a big chunk of responsibility. The tools that they build and push are simply inadequate. The one DRT that I am most familiar with - SmartPath/Monogram for Toyota/Lexus cannot even complete the whole purchase online, the F&I part is only in pilot stage, and it is run by a separate company - TFS, while the rest is run by TMNA.

Trying to scale up some online best practices and training

Sorry, but it doesn't look like it's ready for real business. Is there any evidence of your expertise? Videos, social media? I am not clicking on any Xitter links, sorry.

Then the website looks amateur and not even real. I am looking at this page:

automasterclass.gumroad.com

automasterclass.gumroad.com

2 "Download the playbook" links - neither works.

The image of the "book" has "service, retention, "accuigae"?

Then the website looks amateur and not even real. I am looking at this page:

The Dealer Principal’s Playbook to Building a Profitable CRM Ecosystem

The Dealer Principal’s Playbook to Building a Profitable CRM EcosystemThis is not a CRM book. It is a Dealer Principal operating system.Most dealerships don’t have a CRM problem.They have a control, prioritization, and lifecycle problem.This playbook shows Dealer Principals, Owners, and Managing...

2 "Download the playbook" links - neither works.

The image of the "book" has "service, retention, "accuigae"?

Most Successful Content - Discussion Questions - SEO, Marketing, and Social Media

I’ve seen quality beat quantity every time, especially when the content feels human. Owner-shot videos work wonders, even if they’re a bit rough around the edges. They build trust fast. I’ve also leaned on a marketing agency for clarity on what topics actually move the needle, which saved me from cranking out pointless filler. Mixing data-backed topics with personal touches has been the sweet spot for me.

Skewed? GA4 conversions for google campaigns

Hello Brad,

PMax tends to generate a lot of service and some bad leads if you don't dial it in. Don't just turn their AI features on, otherwise, it will add a bunch of targeting you don't want and it will optimize for the easiest to generate leads (hence service leads).

Most of the time, VLAs tend to generate more calls. VLAs have cheap clicks but lower conversion rates unless you have specialized VDPs just for VLA.

To start tracing back your fake conversions, make sure you connect GA4 with the Google Ads account. Then look at what campaign(s) are generating the leads for the fake leads. You can use UTM tags within the campaigns if you need more detailed tracing.

If you need help with this, feel free to reach out to me directly. Thanks.

PMax tends to generate a lot of service and some bad leads if you don't dial it in. Don't just turn their AI features on, otherwise, it will add a bunch of targeting you don't want and it will optimize for the easiest to generate leads (hence service leads).

Most of the time, VLAs tend to generate more calls. VLAs have cheap clicks but lower conversion rates unless you have specialized VDPs just for VLA.

To start tracing back your fake conversions, make sure you connect GA4 with the Google Ads account. Then look at what campaign(s) are generating the leads for the fake leads. You can use UTM tags within the campaigns if you need more detailed tracing.

If you need help with this, feel free to reach out to me directly. Thanks.

Skewed? GA4 conversions for google campaigns

Recently, we've been doing a manual audit of our form, chat and phone conversions generated by google advertising (search, vla and pmax).

Pmax: in some cases we've seen a lot of bad leads generated. the weird thing is they are real emails, but the people who own them had nothing to do with submitting leads. they are also out of state. we've also had elevated phone calls that dont seem legit. i've heard other people having this issue as well, but love to hear others insight.

VLA: in some of our stores we have seen questionably high form counts.

Does anyone have any tips on how to figure out what is causing some of the fake conversions?

Lastly, on VLA, are you seeing more phone or form conversions?

What are you thoughts on vla vs search in terms of conversions?

Pmax: in some cases we've seen a lot of bad leads generated. the weird thing is they are real emails, but the people who own them had nothing to do with submitting leads. they are also out of state. we've also had elevated phone calls that dont seem legit. i've heard other people having this issue as well, but love to hear others insight.

VLA: in some of our stores we have seen questionably high form counts.

Does anyone have any tips on how to figure out what is causing some of the fake conversions?

Lastly, on VLA, are you seeing more phone or form conversions?

What are you thoughts on vla vs search in terms of conversions?

People's Choice Awards for Best Vehicle Photos?

- By George Nenni

- Vehicle Merchandising & Inventory Software

- 104 Replies

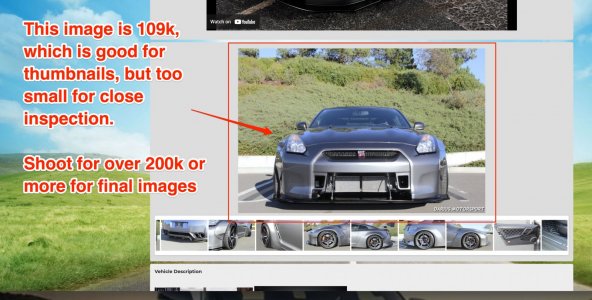

Yes, you can pinch and zoom on iPhone also, but you're zooming on a 100k (100,000 bytes) photo, which is small today's standards. A thumbnail looks ok at 100k or less, but final images need to be 1/4 megabyte (250K) at least IMHO.Thank you, you can zoom in. I guess it works better on Android.

Attachments

People's Choice Awards for Best Vehicle Photos?

- By George Nenni

- Vehicle Merchandising & Inventory Software

- 104 Replies

Hi Darius, I like the photo quality, and order, but could not find a way to supersize the images? All images were small on mobile device (iPhone 16 pro).

What Should the Perfect Dealership Home Page Look Like?

- By nessauto

What platform is clocktowerauto.com built in? Who is the Provider? Seems alot like a overfuel site.

How a CMS Can Make App Development Easier and Faster

- RefreshFriday Weekly Webcast

- 4 Replies

Good post!If you’re building an app, managing content can quickly become a headache. That’s where a CMS for app development comes in. It helps you organize, update, and control content without needing to touch the code every time.

In this guide, we’ll break down what a CMS does, why it matters for app projects, and how to pick the right one for your needs.

So, what exactly is a CMS?

A Content Management System (CMS) is a tool that allows you to create, edit, and manage content—like text, images, videos, and other data—through a user-friendly dashboard. You don’t need to be a developer to use it. That means your marketing or content team can update in-app banners, blog sections, or product descriptions without writing a single line of code.

When it comes to app development, especially for mobile or cross-platform apps, a CMS becomes even more valuable. Instead of hardcoding content into the app, you connect it to a backend CMS. That way, updates happen in real-time, without needing to push a new app update every time something changes.

Why is this important?

Because app users expect fresh, relevant content. Whether it’s updating your home screen offers, publishing a new article, or adding a seasonal banner, being able to make fast changes matters. A CMS for app development gives you that agility.

There are also different types of CMS platforms to choose from. Some are traditional systems like WordPress or Drupal (with mobile support), while others are more advanced headless CMS platforms like Contentful, Strapi, or Sanity. These headless systems are built for flexibility—perfect for developers who want full control over the front end, while content editors can still manage everything from the backend.

Another huge benefit? Scalability. As your app grows—more users, more content, more screens—a CMS helps you stay organized. You can manage content in one place, structure it properly, and deliver it across multiple platforms (web, mobile, even IoT) without duplicating work.

At the end of the day, choosing the right CMS for app development depends on your app’s goals, your team’s technical skills, and how much flexibility you need. But one thing’s for sure—it’s an investment that saves time, cuts down on development costs, and makes life easier for both devs and content teams.

When people talk about CMS making app development faster, I think a lot of it comes down to reducing friction between content and code. I’ve worked on a couple of mobile projects where a decent CMS saved us a ton of time, especially when non-technical folks needed to update content without breaking anything. It also helped keep the app logic cleaner, since we didn’t have to hardcode every little change. While figuring this out for a React Native app, I stumbled across Limeup’s blog post and it honestly matched my own experience pretty well. It breaks down what to look for and how teams usually approach hiring and structuring React Native work, without overhyping things. For me, the biggest win was aligning the CMS setup with the dev workflow early on—once that clicked, updates became way smoother and releases less stressful.

Best stocks in the automotive industry

- By joe.pistell

- Off Topic & Everything Else

- 42 Replies

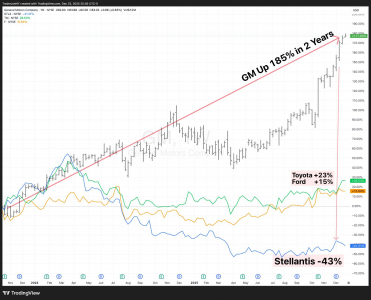

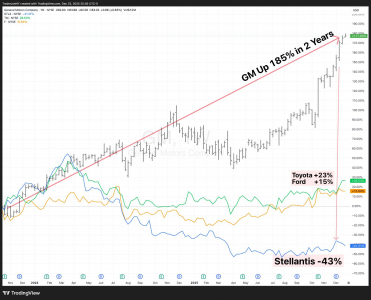

@Eric Miltsch Why chase AI stocks

in 2 years:

#1: General Motors stock +185%

#2: TSLA +130%

#3: BYD +45%

#4: Rivian, Ford & Toyota in the +20-30% area

Bottom Feeders: Stellantis & Nissan MINUS -43%

in 2 years:

#1: General Motors stock +185%

#2: TSLA +130%

#3: BYD +45%

#4: Rivian, Ford & Toyota in the +20-30% area

Bottom Feeders: Stellantis & Nissan MINUS -43%

Used Car Inspection Checklists

- By carlosrpairs

- Vehicle Merchandising & Inventory Software

- 11 Replies

As a small dealer, moving to a formal inspection checklist is a smart step—especially if you’re already selling cars honestly in that price range. In New York, state-licensed shops like Carlos Repairs @Ridge follow clear, measurable standards during inspections, which is a good model to borrow from when building your own checklist. Customers often ask basic questions like “How much is a New York State inspection?”, but what really builds trust is having clear numbers and documentation to back up your answers.

From what I’ve seen:

A solid 40–50 point checklist sounds like the happy medium for your inventory and price range—thorough, professional, and not overkill.

From what I’ve seen:

- Yes—most buyers don’t get an independent inspection, and the ones who do usually already trust their mechanic. Your checklist won’t replace that, but it adds credibility and helps serious buyers feel more confident upfront.

- Keeping it simple works best. A 3-option system (OK / Needs Attention / N/A) with measured notes (tire tread, brake thickness) is usually enough. Too many options can confuse customers.

- As long as you’re clear that it’s a condition report at the time of inspection (not a warranty), you’re generally reducing risk, not increasing it—especially if your checklist mirrors what a New York State inspection already checks for safety and compliance.

A solid 40–50 point checklist sounds like the happy medium for your inventory and price range—thorough, professional, and not overkill.

How a CMS Can Make App Development Easier and Faster

- RefreshFriday Weekly Webcast

- 4 Replies

Thanks for sharingIf you’re building an app, managing content can quickly become a headache. That’s where a CMS for app development comes in. It helps you organize, update, and control content without needing to touch the code every time.

In this guide, we’ll break down what a CMS does, why it matters for app projects, and how to pick the right one for your needs.

So, what exactly is a CMS?

A Content Management System (CMS) is a tool that allows you to create, edit, and manage content—like text, images, videos, and other data—through a user-friendly dashboard. You don’t need to be a developer to use it. That means your marketing or content team can update in-app banners, blog sections, or product descriptions without writing a single line of code.

When it comes to app development, especially for mobile or cross-platform apps, a CMS becomes even more valuable. Instead of hardcoding content into the app, you connect it to a backend CMS. That way, updates happen in real-time, without needing to push a new app update every time something changes.

Why is this important?

Because app users expect fresh, relevant content. Whether it’s updating your home screen offers, publishing a new article, or adding a seasonal banner, being able to make fast changes matters. A CMS for app development gives you that agility.

There are also different types of CMS platforms to choose from. Some are traditional systems like WordPress or Drupal (with mobile support), while others are more advanced headless CMS platforms like Contentful, Strapi, or Sanity. These headless systems are built for flexibility—perfect for developers who want full control over the front end, while content editors can still manage everything from the backend.

Another huge benefit? Scalability. As your app grows—more users, more content, more screens—a CMS helps you stay organized. You can manage content in one place, structure it properly, and deliver it across multiple platforms (web, mobile, even IoT) without duplicating work.

At the end of the day, choosing the right CMS for app development depends on your app’s goals, your team’s technical skills, and how much flexibility you need. But one thing’s for sure—it’s an investment that saves time, cuts down on development costs, and makes life easier for both devs and content teams.

Ready to take your app content management to the next level? Start exploring CMS options and find the one that fits your vision.

Best stocks in the automotive industry

- By Eric Miltsch

- Off Topic & Everything Else

- 42 Replies

Vettx Experience

Our experience with Vettx was poor.

Based on our market, Vettx estimated we would be able to purchase 17 vehicles per month through their program. In reality, we purchased 2 vehicles last month and 1 the month before. The profit generated by the program did not come close to covering the cost.

The program did not perform as it was represented to us. We initially signed up for 6 months, believing the agreement would convert to month-to-month afterward. That was not the case. When we requested cancellation due to poor performance, we were informed that the contract automatically renews for another 6 months, leaving us locked into the program.

I reviewed the situation in detail with them and requested early cancellation, which they refused.

Additionally, Vettx stated that they informed us of the renewal and provided recommendations, which we did not receive. These items were also not part of the original discussion tied to the 17-vehicle estimate. Those recommendations included:

Based on our market, Vettx estimated we would be able to purchase 17 vehicles per month through their program. In reality, we purchased 2 vehicles last month and 1 the month before. The profit generated by the program did not come close to covering the cost.

The program did not perform as it was represented to us. We initially signed up for 6 months, believing the agreement would convert to month-to-month afterward. That was not the case. When we requested cancellation due to poor performance, we were informed that the contract automatically renews for another 6 months, leaving us locked into the program.

I reviewed the situation in detail with them and requested early cancellation, which they refused.

Additionally, Vettx stated that they informed us of the renewal and provided recommendations, which we did not receive. These items were also not part of the original discussion tied to the 17-vehicle estimate. Those recommendations included:

- Providing more aggressive offers to remain competitive in our market

- Picking up vehicles to make acquisitions more convenient for sellers

- Emphasizing the use of Autotrader and creating a new account (which we already have)

Familiar with Vettx - Used Car Acquisition Software?

- By Eric Damiani

- Vehicle Merchandising & Inventory Software

- 20 Replies

Our experience with Vettx was poor.

Based on our market, Vettx estimated we would be able to purchase 17 vehicles per month through their program. In reality, we purchased 2 vehicles last month and 1 the month before. The profit generated by the program did not come close to covering the cost.

The program did not perform as it was represented to us. We initially signed up for 6 months, believing the agreement would convert to month-to-month afterward. That was not the case. When we requested cancellation due to poor performance, we were informed that the contract automatically renews for another 6 months, leaving us locked into the program.

I reviewed the situation in detail with them and requested early cancellation, which they refused.

Additionally, Vettx stated that they informed us of the renewal and provided recommendations, which we did not receive. These items were also not part of the original discussion tied to the 17-vehicle estimate. Those recommendations included:

Based on our market, Vettx estimated we would be able to purchase 17 vehicles per month through their program. In reality, we purchased 2 vehicles last month and 1 the month before. The profit generated by the program did not come close to covering the cost.

The program did not perform as it was represented to us. We initially signed up for 6 months, believing the agreement would convert to month-to-month afterward. That was not the case. When we requested cancellation due to poor performance, we were informed that the contract automatically renews for another 6 months, leaving us locked into the program.

I reviewed the situation in detail with them and requested early cancellation, which they refused.

Additionally, Vettx stated that they informed us of the renewal and provided recommendations, which we did not receive. These items were also not part of the original discussion tied to the 17-vehicle estimate. Those recommendations included:

- Providing more aggressive offers to remain competitive in our market

- Picking up vehicles to make acquisitions more convenient for sellers

- Emphasizing the use of Autotrader and creating a new account (which we already have)

Load more